Quick car title loans, popular for swift cash access, require minimal documentation and allow borrowers to retain vehicle possession. While offering fast approval and flexible terms, these loans often have higher interest rates and shorter repayment periods compared to traditional bank loans that provide lower rates, longer terms, and diverse payment options. Timely repayment is crucial to avoid losing vehicle ownership.

In today’s fast-paced world, access to immediate financial support is crucial. Among various options, Quick Car Title Loans have gained popularity as an alternative to traditional banking routes. This article delves into the intricacies of these short-term secured loans, offering a comprehensive overview. We explore how they differ from conventional bank loan options, focusing on their advantages and potential drawbacks. By understanding both, borrowers can make informed decisions, ensuring the best financial strategy for their needs.

- Understanding Quick Car Title Loans: An Overview

- Bank Loan Options: Traditional Approaches Explored

- Comparing Pros and Cons: Loans at a Glance

Understanding Quick Car Title Loans: An Overview

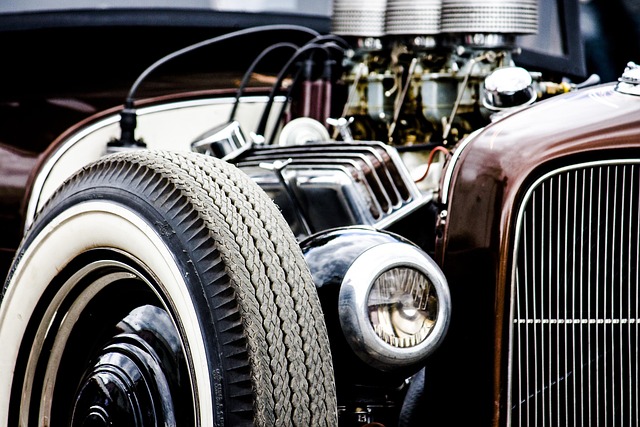

Quick car title loans have gained popularity as a fast and convenient way to access cash, especially for those who own their vehicles outright. This type of loan is a secured lending option, where the borrower uses their vehicle’s title as collateral. The process typically involves a straightforward application, requiring basic information and proof of ownership. Once approved, lenders will disburse the funds, often within a short period.

In Houston, for instance, the Title Loan Process can be even more accessible with specialized lenders offering these services. Borrowing against your vehicle’s title allows you to maintain possession of your car while providing a safety net during financial emergencies. It’s a quick fix for immediate cash needs but carries risks if you’re unable to repay on time, as it may result in losing ownership of your vehicle.

Bank Loan Options: Traditional Approaches Explored

When considering short-term financial solutions, many individuals often explore various loan options available from traditional banks. These conventional approaches have been a staple for decades, offering a range of products to cater to different borrower needs. One common and well-established method is the standard bank loan, which typically requires applicants to undergo rigorous credit checks and provide extensive documentation. This process can be time-consuming, often taking several days or even weeks to finalize, making it less appealing for those seeking quick access to funds.

In contrast, car title loans present a more direct and expedited alternative. Unlike traditional bank loans that rely heavily on creditworthiness, these loans utilize the equity in an individual’s vehicle as collateral. With options like no credit check loans, borrowers can gain approval faster, sometimes within the same day. This makes car title loans, including title pawn services, a preferred choice for those needing immediate financial support, especially when traditional banking methods fall short due to strict borrowing criteria.

Comparing Pros and Cons: Loans at a Glance

When comparing quick car title loans to traditional bank loan options, it’s crucial to weigh the pros and cons of each. These short-term loans, often advertised in San Antonio and other cities, offer remarkably quick approval times and flexible payment plans. However, they typically come with higher interest rates and shorter repayment periods than typical bank loans. This can make them a less sustainable option for long-term financial needs.

While quick car title loans may be attractive due to their speed and accessibility, it’s important to consider the potential drawbacks. Bank loans, on the other hand, often provide lower interest rates and longer terms, making them a more affordable choice for borrowers with stable income and good credit history. Additionally, bank loans usually offer a variety of payment plans and may come with built-in protections that are absent in many car title loan agreements.

When considering your financial options, it’s clear that Quick Car Title Loans offer a compelling alternative to traditional bank loans. By leveraging your vehicle’s equity, these loans provide faster access to cash with simpler qualification criteria. However, they also come with higher interest rates and the potential for repossession if repayments are missed. Bank loan options, while often more regulated and secure, can be time-consuming to process and may not be suitable for those with limited credit history. Ultimately, the choice depends on your individual circumstances and risk tolerance, with Quick Car Title Loans offering speed and flexibility but demanding careful consideration of the associated risks.